The Wine Intelligence Global Wine Power Index 2020 has been released with Australian brand Yellow Tail taking out the title of the most powerful and influential wine brand in the world.

The third annual survey from international wine research authority, Wine Intelligence, used feedback from more than 20,000 wine consumers in 21 markets, which the company says represents 380 million wine drinkers globally.

Markets included the UK, Australia, China, the Netherlands, and newcomers Mexico, Hong Kong and Finland – however New Zealand was not included.

This year the Index tracked brand influence, consumer awareness and purchase levels and the consumer’ ‘affinity’ with the brand. The survey did not take into account the sales volumes or value, sales trends over time or opinions of those in the supply chain and/or influencers and media.

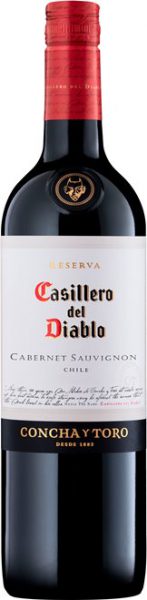

Yellow Tail and Casillero del Diablo once again top the Global Wine Brand Power Index, claiming the top two spots, respectively. As such, Australian and Chilean brands perform very well in the index relative to the size of wine production in these countries.

In addition, one-third of the top 15 is comprised of US brands – notably Gallo and Barefoot – which in part is due to the influence of the large US wine drinking population in the study, and the affinity American consumers show towards domestic wines.

“The advantages of a powerful brand are clearly demonstrated in the global wine market today,” says Wine Intelligence CEO Lulie Halstead. “However the path to becoming a power brand is becoming harder, as consumer knowledge levels in the wine category decline and ‘noise’ from other drinks categories increases.”

Notable movers on the Global Wine Brand Power Index include Barefoot, which has jumped eight places to make it into the top five, and Frontera, which has climbed seven places to make eighth in the index. Santa Carolina has also climbed seven places to tie for 12th with Beringer. On the other hand, Mouton Cadet has fallen five places to 10th and Robert Mondavi has fallen seven places to sit at 14. Torres has also climbed two places to make it into the top 15 this year.

Jacob’s Creek is ranked fourth in the Index, dropping down from third in 2019, while Lindeman’s has moved up one place from 12th to 11th.

The top 10

1. Yellow Tail

Australia’s Yellow Tail scored in the top five with consumers from Canada, China, Hong Kong, South Korea, the UK and the US.

2. Casillero del Diablo

Highly regarded at home in Chile, as well as in Colombia and Ireland, Casillero del Diablo is owned by Chilean wine giant Concha Y Toro and is one of the company’s most valuable brands.

3. Gallo Family Vineyards

The top US scorer in the survey with 68/100, California’s E&J Gallo is responsible for 40% of all wine production in California. Its Gallo Family brand is the most lucrative and is one of the most widely distributed wines in the report.

4. Jacob’s Creek

Falling one place since the 2019 survey, Australia’s Jacob’s Creek – owned by Pernod Ricard – often features in the list due to its wide distribution.

5. Barefoot

California wine giant Barefoot took out the number five spot and was the most popular brand in Canada, the US, and the UK.

6. Gato Negro

Chilean brand Gato Negro sells more than four million cases in 70 countries on five continents – that’s two bottles uncorked every second.

7. Carlo Rossi

This 40-year-old brand is produced by the E & J Gallo Winery and was named after Charles Rossi, at the time a salesman for Gallo and a relation of the Gallo family by marriage.

8. Frontera

Also owned by Chile’s Concha Y Toro, Frontera jumped seven places from its 2019 score.

9. J.P. Chenet

This French wine with a curved bottleneck distributes to more than 160 countries and scored 29.8 in this year’s survey.

10. Mouton Cadet

Dropping significantly from last year, the French brand lost points across a number of factors, including brand awareness, rate of purchase, and affinity.

Edited from a story by Andy Young, originally featured on www.theshout.com.au